Trump turns up the heat on Powell over rate cuts

"Consumers have been waiting for years to see pricing come down."

President Trump again urged the Federal Reserve to slash interest rates, despite a robust April jobs report that supports Chair Jerome Powell’s cautious stance. The report, showing 177,000 jobs added, signals economic strength, aligning with Powell’s view that rates should hold steady to manage inflation risks from Trump’s tariff policies.

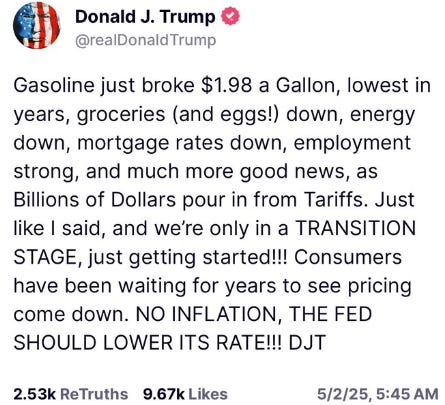

What they’re saying: Trump, posting on Truth Social, insisted inflation is no longer a threat and rates must drop to boost growth.

”Gasoline just broke $1.98 a Gallon, lowest in years, groceries (and eggs!) down, energy down, mortgage rates down, employment strong, and much more good news, as Billions of Dollars pour in from Tariffs. Just like I said, and we’re only in a TRANSITION STAGE, just getting started!!! Consumers have been waiting for years to see pricing come down. NO INFLATION, THE FED SHOULD LOWER ITS RATE!!! DJT”

This follows his softened rhetoric toward Powell, whom he recently said he has “no intention” of firing after earlier threats. Powell, backed by law ensuring Fed independence, has resisted, warning tariffs could spike prices. Analysts note rate cuts now could fuel inflation, countering Trump’s goal of lower borrowing costs. Markets rose slightly, but experts see Powell’s patience prevailing.

Why it matters: Trump’s pressure tests the Fed’s autonomy, risking market volatility if investors doubt its inflation control.

By the numbers: April’s job growth trailed March’s revised 185,000 but beat expectations, with unemployment steady at 3.9%.

What’s next: The Fed’s May 6-7 meeting will likely maintain rates, defying Trump’s calls.

Two major banks BOTH predict interest rate cuts coming in July!

Strong U.S. jobs data has prompted Barclays and Goldman Sachs to shift their expectations for the next Federal Reserve rate cut from June to July, signaling a robust economy delaying monetary easing.

The details: Barclays and Goldman Sachs now anticipate the Federal Reserve will delay its next interest rate cut until July, revising earlier June predictions, per a Yahoo Finance report.

What they’re saying: The shift follows a stronger-than-expected April nonfarm payrolls report, with Barclays noting the data "suggests the Fed will likely wait" due to persistent economic strength. Goldman Sachs echoed this, citing the jobs report and a solid April ISM reading as reasons to push back the cut. Both banks expect a cautious Fed, balancing inflation control with growth.

The big picture: The jobs data underscores a resilient labor market, reducing urgency for immediate rate relief. This aligns with broader market sentiment, as investors adjust to a higher-for-longer rate environment. The Fed’s next moves hinge on upcoming inflation and employment figures, with July emerging as the new focal point for policy shifts.

DOGE Bolsters SEC Presence Amid Workforce Cuts

Elon Musk’s Department of Government Efficiency (DOGE) is expanding its footprint at the U.S. Securities and Exchange Commission (SEC) by adding a third staff member, sources tell Reuters. The move comes as DOGE, led by Musk, pushes to streamline federal operations under President Trump’s administration.

The details: The SEC, tasked with fraud detection and financial stability, faces challenges from a depleted workforce following White House-driven cuts. Critics warn that staff reductions could impair the agency’s oversight functions.

What they’re saying: During Senate testimony, new SEC Chairman Paul Atkins pledged to collaborate with DOGE to boost efficiencies while maintaining “fair, orderly, and efficient markets.” Neither the SEC nor the White House directly addressed Reuters’ inquiries.

Dive deeper: DOGE’s growing role at the SEC reflects its broader mission to curb federal spending, though its aggressive cuts have sparked concerns about regulatory effectiveness. With Musk scaling back his DOGE involvement to focus on Tesla, the initiative’s long-term impact remains uncertain.

The big picture: DOGE’s expansion into Wall Street’s top regulator underscores Trump’s push for leaner government, but risks weakening critical financial oversight.

Dow Surges 400 Points as Jobs Report Fuels Market Optimism

The Dow Jones Industrial Average soared 440 points Friday, fueled by a stronger-than-expected April jobs report, while the S&P 500 eyed its ninth straight day of gains—its longest winning streak since 2004. The Nasdaq Composite also climbed 1.2%.

Why it matters: The U.S. economy added 177,000 jobs last month, topping economists’ forecasts of 133,000, easing recession fears after a turbulent April sparked by President Trump’s tariffs. The S&P 500 has now erased losses since the tariff announcement, signaling renewed investor confidence.

What they’re saying: “A more severe response to the tariff and DOGE shocks may well emerge, but the absence of early labor market deterioration makes it less likely the Fed will cut rates in June,” said Krishna Guha of Evercore ISI.

By the numbers: On open the S&P 500 rose 1.2% to 5,604.14, the Dow gained 1.1% to 40,752.96, and the Nasdaq jumped 1.2% to 17,710.74. This trend has continued all day.

The big picture: Strong tech earnings from Microsoft and Meta, coupled with the jobs data, have revived the AI trade, pushing markets toward recovery despite ongoing trade policy uncertainty.